About half of the last quarter of 2020 has passed. This is the first fiscal quarter with the highest revenue of the technology giant Apple (AAPL.US) this fiscal year. Recently, there are some situations that may make investors a little worried in the short term. However, every investor needs to realize that buying Apple today is not a bet on a quarter’s performance, but a long-term investment that may take time to return.

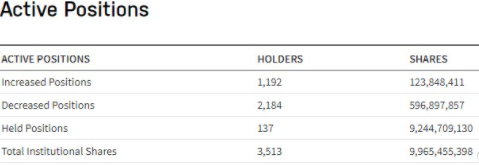

Investors may first worry about the latest set of institutional position data. As shown in the figure below, Zhitong Finance has observed that thelargest companies that have released data are the major net sellers of Apple stock in the third quarter. Ten of these companies sold at least 15 million shares of Apple stock (after the split adjustment) during the quarter, and half of them lost at least 32 million shares. On the other hand, only two companies increased their holdings by 6 million shares.

Is this a one-time sale, or is it a sign of continued sale in the future? This is a very important question. Some people might say that considering the stock’s sharp rise in the past year, this is just some natural profit taking.

Another thing that may cause trouble for stock prices is that expectations for current quarterly performance continue to rise. For several years, everyone has been waiting for Apple to release a 5G-compatible iPhone, which is generally believed to lead to a super cycle of upgrades. Unfortunately, this may cause the stock to fail in the short term, as we saw in the fourth quarter results.